Roth 401k employer match calculator

How do Roth 401k matching contributions work. Maximum 401k Contribution Limits.

The Maximum 401k Contribution Limit Financial Samurai

Your employer will too.

. The same rules apply to a Roth 401k but only if the employers plan permits. Maximize Employer 401k Match Calculator. A 401k is an employer-sponsored tax-advantaged retirement plan.

With this key job benefit your employer adds to the money you save boosting your 401k account over the long term. Make sure you are on track to meet your investing goals. Operate and Maintain a 401k Plan.

In fact if your employer offers matching dollars. It shares certain similarities with a traditional 401k and a Roth IRA although there are important. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

A solo Roth 401k works just like a Roth 401k option in a regular employer-sponsored 401k. Yours employer match catch-up an estimate for return on investment and the number of years until retirement then. If your employer will match 401k contributions in full up to 3000 then your best bet is to put 3000 into your 401k to get that benefit.

Operating a 401k plan. A 401k match is money your employer contributes to your 401k. A 401k account is an easy and effective way to save and earn tax deferred dollars for retirement.

Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. And the Roth component of a Roth 401k gives you the benefit of tax-free. A Roth 401k gives you a similar tax me.

Funds are added directly to your 401k account. 61000 67500 if youre age 50 or older includes salary deferral amount and employer matches. Its also important to know that if you have a Roth 401k that has any employer matching funds in it those matching funds are categorized as a traditional 401k contribution.

Income taxes on matching funds also are deferred until savings are withdrawn. 20500 27000 if youre age 50 or older. How to establish designated Roth accounts in a 401k plan.

A 401k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. If the employer made a 50 match the match amount would be 2500. If youre 50 or older you can add an additional 6500 per year for a total of 27000.

From there you can divide your remaining 2000. Many employers offer 401k matching contributions as part of their benefits package. In 2022 you can invest up to 20500 a year in a 401k 403b or in most 457b plansnot including the employer match.

When employers make matching contributions to a Roth 401k the money goes into a separate traditional 401k account not into the Roth account. The Roth 401k was introduced in 2006 and combines the best features from the traditional 401k and the Roth IRA. Mid-year Amendments to Safe Harbor 401k Plans and Notices.

You fund this account by contributing a set percentage of your paycheck into the account. Qualifying employees designated by employer. Theres also a surefire way to boost the returns on the money you contribute which is to take full advantage of your employers 401k match.

In addition many employers will match a portion of your contributions so participation in your employers 401k is like giving yourself a raise and a tax break at the same time. A Roth 401k is an account funded with after-tax contributions. Some employers match your contributions.

One of the biggest perks of a 401k plan is that employers have the option to match your contributions to your account up to a certain point. Roth 401k Employees of for-profit companies. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account.

The Roth 401k is somewhat different from the traditional 401K as a retirement savings plan. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. This simple 401k savings calculator estimates your retirement investment growth and explains why.

If the funds in your 401k plan run higher than 1 percent and youve maxed out any employer match strongly consider investing in a Roth IRA. With a Roth 401k you can take advantage of the company match on your contributions if your employer offers onejust like a traditional 401k. Commonly that match will be worth 50 to 100 of.

With a 401k match your employer agrees to duplicate a portion of your. Thats a lot of money. A hardship withdrawal allows the owner of a 401k plan or a similar retirement plan such as a 403b to withdraw money from the account to meet a dire financial need.

In certain situations a traditional IRA offers penalty-free withdrawals even when an employer-sponsored plan does. Federal requirements determine who employer must offer plan to. Participate in a 401k Plan.

Step 5 Determine whether the contributions are made at the start or the end of the period. Plus workers can mix and match between Roth and traditional contributions up to those limits. Salary deferral limits for 2022.

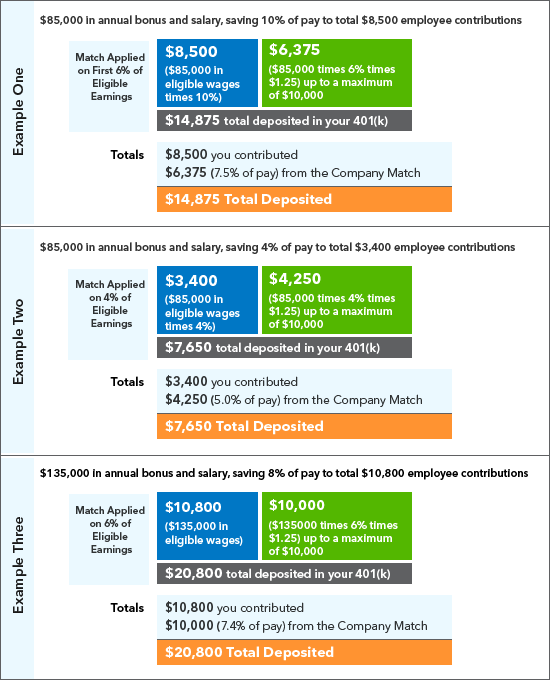

As a benefit to employees some employers will match a portion of an employees 401k contributions. The employer would make a matching contribution of 3000. Total contribution limits for 2022.

So if you. General guidance on participating in your employers plan. Employers may even match Roth 401k contributions.

If your company matches 50 of your contribution. An employer-sponsored Roth 401k plan is similar to a traditional plan with one major exception. This is the big one.

You make pre-tax contributions and pay tax on withdrawals in retirement. Correct a 401k Plan.

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

401 K Plan What Is A 401 K And How Does It Work

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Roth Vs Traditional 401k Fidelity

Roth Solo 401k Contributions My Solo 401k Financial

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

401 K Savings Plan Intuit Benefits U S

Traditional 401 K Vs Roth 401 K Ubiquity

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Traditional 401 K Vs Roth 401 K Ubiquity

The Ultimate Roth 401 K Guide District Capital Management

Vanguard Consider The Advantages Of Roth After Tax Contributions

401 K Calculator See What You Ll Have Saved Dqydj

Roth 401k Might Make You Richer Millennial Money